Protect data privacy in the Insurance field

Challenge

A car insurance provider wants to use an internet-of-things (IoT) application to collect and manage customer data. The company collects data through IoT devices in the cars of their customers. It needs a platform in which this data is managed and leveraged to create business intelligence. Four potential vendors are offering such platforms. The insurance provider wants product demonstrations from each of them to make an informed decision. Unfortunately, such a demonstration requires the insurer’s customer data.

Solution

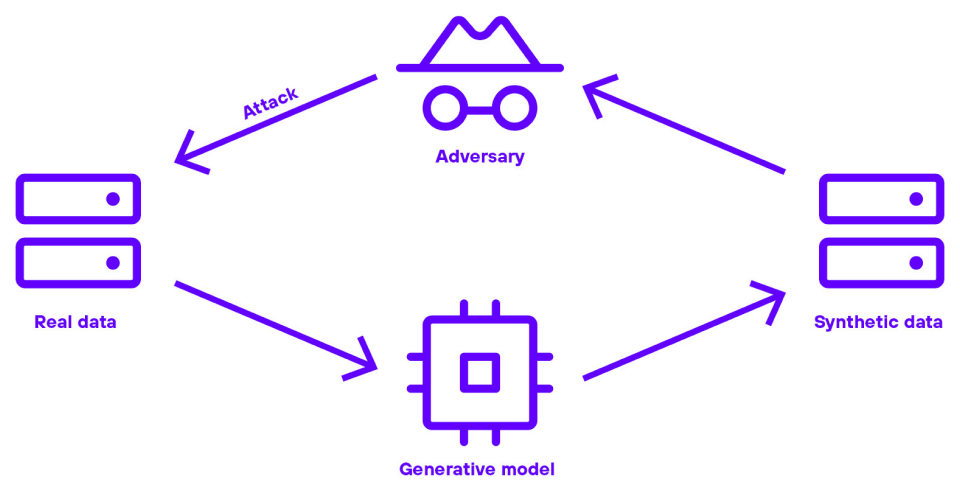

The car insurance provider integrated Aindo's Synthetic DataOps Platform on their infrastructure. They connected it to a relational database containing customer information. Our platform generated a database of artificial customer records with the same format and properties as the original database. This synthetic data was securely generated on-site, without the insurer’s real data ever leaving its original IT environment.

The insurer provided the synthetic dataset to the four potential vendors. These vendors used it to demonstrate their products without needing access to the insurer’s confidential information. Synthetic data was also applied to simulate special events. For example, an additional experiment was conducted in which data was rebalanced so that the number of long-distance commuters was relatively large. This showed how well the software responded to changes in customer behavior.

Benefits

Through Aindo’s synthetic data, the insurer could make an informed decision, substantially reducing risks. The process also showcased that synthetic data can dramatically shorten software development cycles. Risks were further reduced through data augmentation for simulating special events, showcasing the robustness of each of the products.